CMHC increases Vancouver’s housing market risk

Posted July 27, 2016 11:35 am.

Last Updated July 27, 2016 11:55 am.

This article is more than 5 years old.

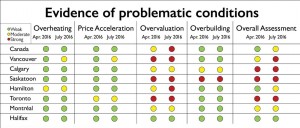

OTTAWA, ON. (NEWS 1130) – According to the Canadian Mortgage and Housing Corporation there are “strong” signs of problematic conditions and imbalances within Vancouver’s real estate market that has led to a “high” risk rating in the city.

That is the agency’s highest warning level. It was “moderate” in April and considered “weak” in January. The Ottawa-based agency is also pointing out the west coast of Canada is at high risk of overvaluation, price acceleration and demand that is crippling supply.

The concern is prices increasing as quickly as we’ve seen in some of the country’s largest cities, including Vancouver, could drag the entire national market into a problematic category.

“By the time of the next Housing Market Assessment in October, growth in home prices in parts of British Columbia and Ontario may have been sufficient to provide strong evidence of problematic conditions for Canada overall,” the agency said in the report.

Following months of anger from would-be homeowners, the provincial government earlier this week unveiled a 15 per cent tax on foreign buyers while Bank of Canada Governor Stephen Poloz recently warned buyers to plan for the possibility that prices may stall or decline. And a local expert feels there’s a possibility the local market will crash sooner than later.

The benchmark price for a single-family detached home in Vancouver is $1.56 million right now, it was $1.18 in June.

“We’re seeing prices increasing whereas previously when we had weak evidence for this indicator it was really just the single-family home sector that was showing very steep price increases. But over the last couple of quarters we’ve also started to see condo prices increasing and this is really reflecting very strong demand for this more affordable home-type,” explains Robyn Adamache, the CMHC’s Principal Market Analyst in Vancouver.